Our recurring revenue analysis programs create added revenue of $1 million for every $1 billion in bank assets. We traditionally find 51% of additional revenue through optimizing core banking system settings.

Most recommendations do not require a disclosure. To capture lost revenue, most changes can be implemented in minutes on the core system, which often adds millions in additional recurring revenue.

Lodestone Banking increases revenues without cutting staff, closing branches, cost cuts & savings of any kind and rarely result in increasing customer fees.

Lodestone Banking delivers detailed documentation and quantifiable results. We provide implementation and tracking procedures so clients are able to follow their day to day increases in revenue.

Lodestone Banking delivers personalized, real results by identifying profit enhancements that other consulting firms cannot. We know this because we often have clients that have worked with several consulting firms, before turning to Lodestone Banking. Our dedicated consultants excel at serving our clients’ needs while sharing information on how to best optimize the bank’s business practices. Lodestone is skilled in structuring recommendations to fit each client’s unique requirements and market situation.

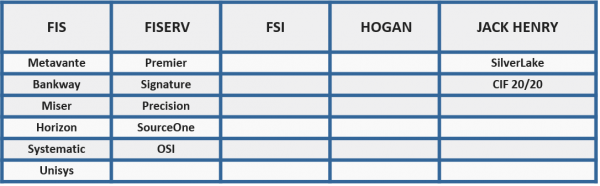

Lodestone Banking has developed queries to find lost revenue on these core banking systems: